The 20-Second Trick For Mileagewise - Reconstructing Mileage Logs

The 20-Second Trick For Mileagewise - Reconstructing Mileage Logs

Blog Article

Some Known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

Table of ContentsNot known Factual Statements About Mileagewise - Reconstructing Mileage Logs All about Mileagewise - Reconstructing Mileage LogsRumored Buzz on Mileagewise - Reconstructing Mileage LogsSee This Report about Mileagewise - Reconstructing Mileage LogsThe smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking AboutMileagewise - Reconstructing Mileage Logs Things To Know Before You Get ThisExcitement About Mileagewise - Reconstructing Mileage Logs

Timeero's Quickest Range attribute recommends the fastest driving path to your staff members' destination. This attribute improves performance and contributes to set you back financial savings, making it a crucial property for businesses with a mobile labor force. Timeero's Suggested Route feature even more boosts liability and effectiveness. Employees can compare the recommended path with the actual course taken.Such an approach to reporting and conformity streamlines the commonly complicated job of handling mileage costs. There are many benefits associated with using Timeero to keep track of mileage. Let's have a look at a few of the app's most notable attributes. With a relied on mileage monitoring tool, like Timeero there is no requirement to bother with unintentionally leaving out a day or piece of information on timesheets when tax obligation time comes.

Examine This Report about Mileagewise - Reconstructing Mileage Logs

With these tools in operation, there will be no under-the-radar detours to increase your compensation prices. Timestamps can be found on each mileage entrance, increasing reliability. These additional confirmation measures will maintain the internal revenue service from having a reason to object your mileage records. With accurate mileage monitoring innovation, your workers don't need to make harsh gas mileage estimates or perhaps fret about mileage expenditure monitoring.

As an example, if an employee drove 20,000 miles and 10,000 miles are business-related, you can compose off 50% of all auto costs. You will certainly need to proceed tracking gas mileage for work also if you're making use of the actual expenditure approach. Keeping gas mileage records is the only way to separate organization and personal miles and supply the proof to the IRS

A lot of mileage trackers let you log your journeys by hand while calculating the distance and compensation quantities for you. Lots of also come with real-time trip monitoring - you need to start the application at the beginning of your trip and quit it when you reach your last destination. These applications log your start and end addresses, and time stamps, together with the total distance and repayment quantity.

Facts About Mileagewise - Reconstructing Mileage Logs Uncovered

Among the concerns that The IRS states that vehicle costs can be considered as an "regular and essential" price during doing company. This includes costs such as gas, upkeep, insurance policy, and the lorry's devaluation. For these expenses to be taken into consideration insurance deductible, the car ought to be made use of for service objectives.

Getting The Mileagewise - Reconstructing Mileage Logs To Work

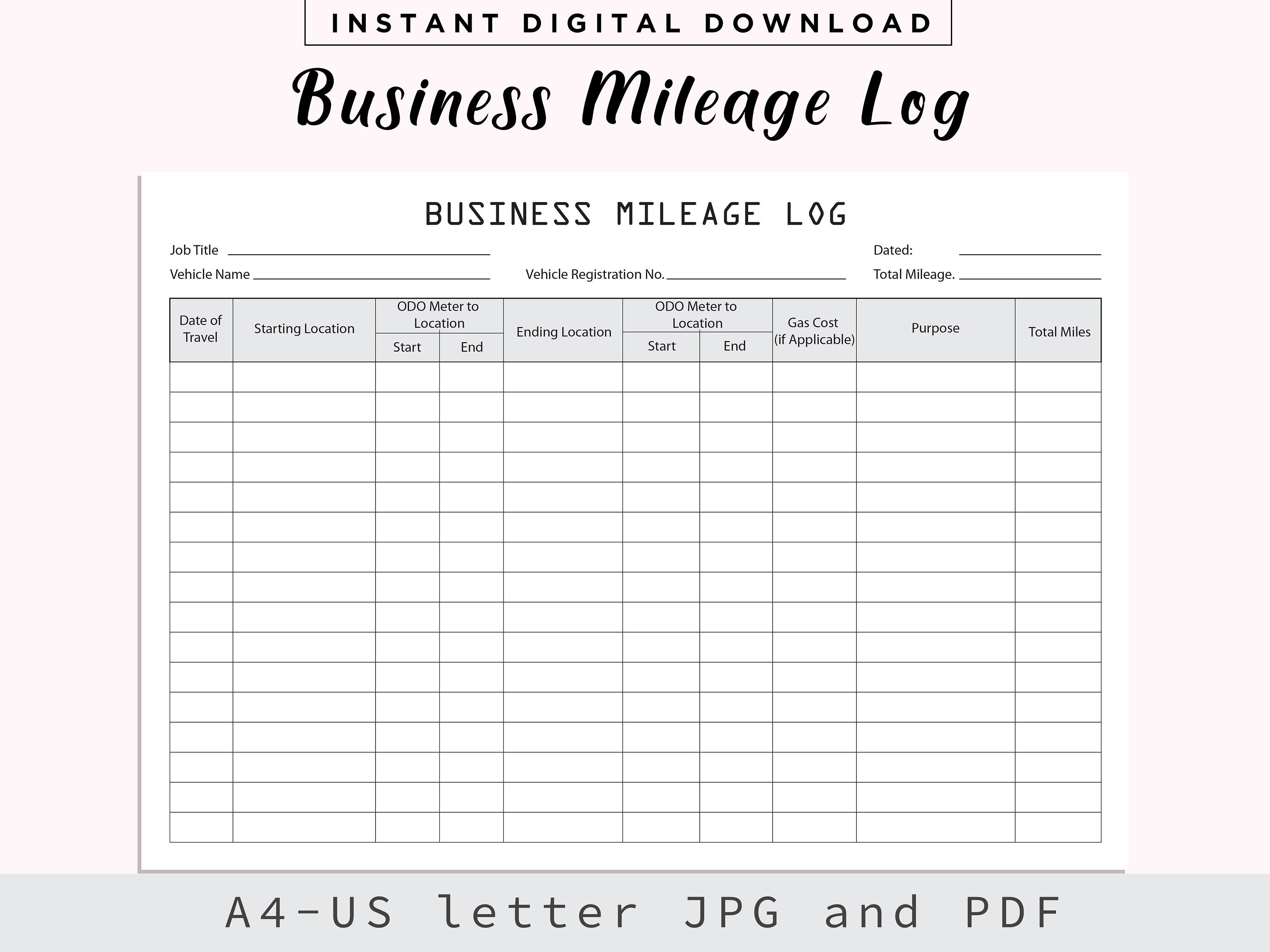

Start by videotaping your vehicle's odometer reading on January 1st and afterwards once more at the end of the year. In between, vigilantly track all your business journeys taking down the beginning and finishing readings. For every trip, document the place and company function. This can be simplified by keeping a driving log in your car.

This consists of the total service mileage and total gas mileage build-up for the year (organization + official site individual), trip's date, destination, and objective. It's crucial to tape-record activities quickly and maintain a contemporaneous driving log detailing date, miles driven, and service function. Here's just how you can improve record-keeping for audit objectives: Start with making sure a careful mileage log for all business-related traveling.

Some Known Details About Mileagewise - Reconstructing Mileage Logs

The actual expenses method is an alternative to the typical mileage price method. Rather than determining your deduction based upon a predetermined price per mile, the actual costs technique permits you to subtract the real prices linked with using your lorry for service objectives - mileage tracker. These costs include fuel, upkeep, repair services, insurance coverage, depreciation, and various other associated expenditures

Those with considerable vehicle-related expenses or one-of-a-kind problems may benefit from the real expenses technique. Please note electing S-corp standing can change this estimation. Eventually, your picked technique must straighten with your specific monetary objectives and tax obligation scenario. The Criterion Mileage Rate is a measure issued yearly by the internal revenue service to establish the insurance deductible costs of operating an auto for company.

What Does Mileagewise - Reconstructing Mileage Logs Do?

(https://www.kickstarter.com/profile/mi1eagewise/about)Whenever you use your car for company trips, tape the miles traveled. At the end of the year, again write the odometer reading. Determine your overall business miles by using your beginning and end odometer analyses, and your recorded service miles. Accurately tracking your precise mileage for organization trips help in confirming your tax obligation deduction, specifically if you select the Requirement Gas mileage method.

Keeping track of your mileage by hand can require diligence, however bear in mind, it can save you cash on your taxes. Tape the overall gas mileage driven.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

In the 1980s, the airline company market became the very first commercial users of GPS. By the 2000s, the delivery industry had taken on general practitioners to track plans. And now almost everyone uses GPS to obtain about. That means almost every person can be tracked as they tackle their company. And there's snag.

Report this page